wv state inheritance tax

Hawaii and Washington State have the highest estate tax top rates in the nation at 20 percent. West Virginia AMBER Alerts Receive AMBER Alerts on missing children based on your state of residence.

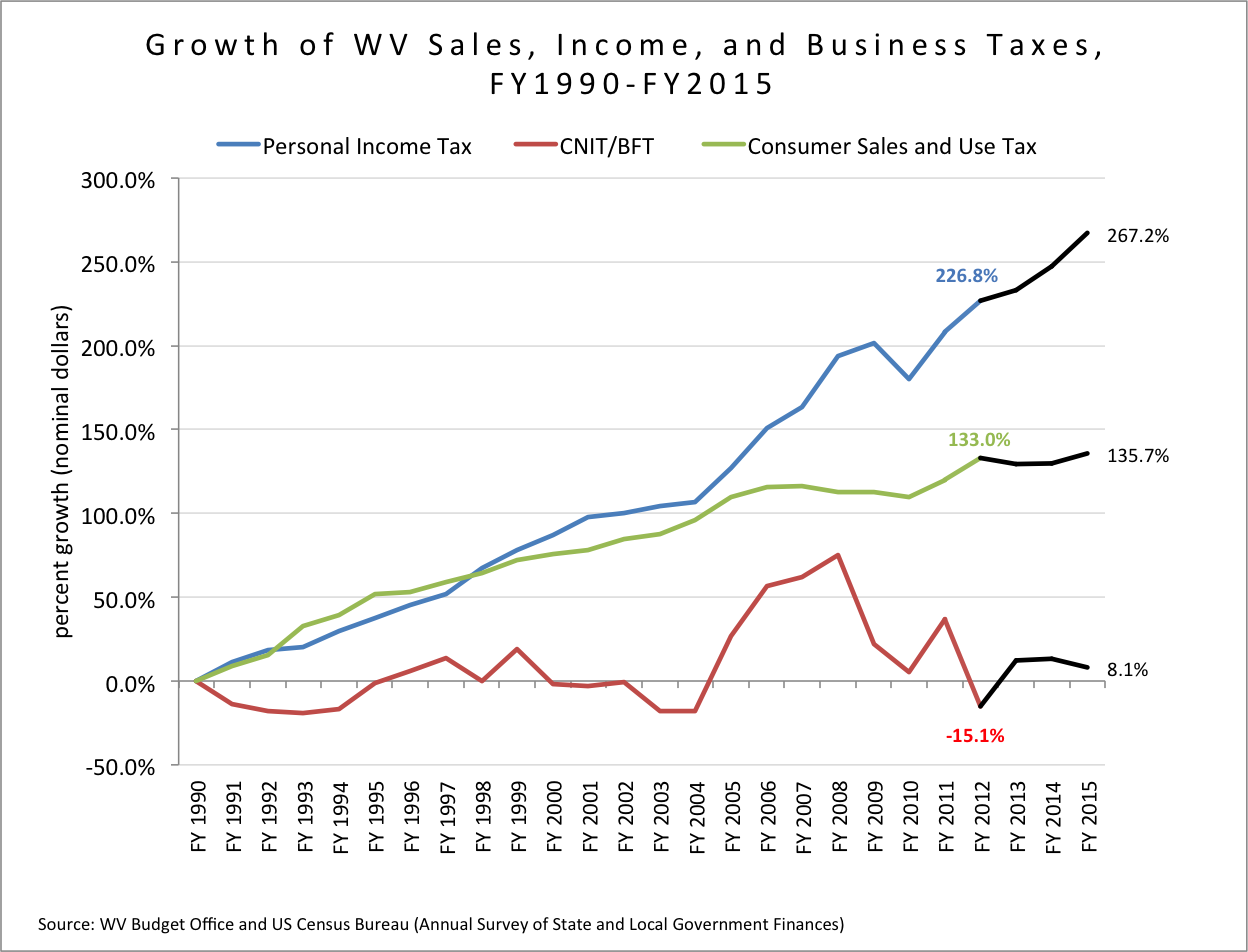

West Virginia Income Tax Repeal Evaluating Plans Tax Foundation

Municipalities can add up to 1 to that with an average combined rate of 652 according to the Tax Foundation.

. Before January 1 2005 West Virginia did collect an estate tax that was in proportion to the overall federal estate tax bill but when the federal tax law changed West. Although there is no WV inheritance tax that does not mean that you might not be subject to an inheritance tax. 3 on up to 10000 of taxable income High.

Tax Information and Assistance. 65 on taxable income of 60000 or more West Virginia municipalities can also. West Virginia Sales Tax.

Tax Information and Assistance. An estate tax is. Try it for free and have your custom legal documents ready in only a few minutes.

Both are collected as the result of someones death but an inheritance tax is based on an individual bequest of propertyliterally each inheritance. West Virginia County and State Taxes This service reminds you when your. There are limits that must be reached.

West Virginia Inheritance Tax Laws. 304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map You are about to open a link to the website of another organization. Inheritence Estate Tax.

77 Fairfax Street Room 102. The absence of gift tax in West Virginia allows you to start. 45 percent on transfers to direct descendants and lineal heirs.

Try it for free and have your custom legal documents ready in only a few minutes. There are 38 states in the. Berkeley Springs WV 25411.

Considered a part-year resident because you moved into or out of West Virginia. West Virginia Income Tax Range. Eight states and the District of Columbia are next with a top rate of 16 percent.

Mark IT-140 as a Nonresident and complete Schedule A A full-year resident of Ohio Pennsylvania Maryland. It exceeds the 2022 federal estate tax exemption bar of 1206 million by 940000 which becomes taxable. As a result West Virginia no longer imposes a state estate tax.

15 percent on transfers to other heirs except charitable organizations exempt institutions and government entities exempt. 304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map You are about to open a link to the website of another organization. When you go through probate administration its important to keep in mind the specific state laws for taxes and seek legal advice.

Wv Budget Gap A Revenue Problem Part 2 West Virginia Center On Budget Policy

States With No Estate Or Inheritance Taxes

What Is Inheritance Tax Probate Advance

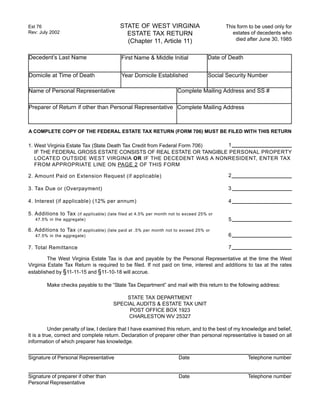

Estate Tax Form Remittance Memo Decedents Dying On Or After Ju

Complete Guide To Probate In West Virginia

State Tax Levels In The United States Wikipedia

Free West Virginia Small Estate Affidavit Form Pdf Eforms

Estate Tax Planning Techniques Blog Jenkins Fenstermaker Pllc

A Guide To West Virginia Inheritance Laws

How To Fit An Ira In Your Wv Estate Plan Blog Jenkins Fenstermaker Pllc

Pay Taxes Kanawha County Sheriff S Office

State By State Estate And Inheritance Tax Rates Everplans

Free West Virginia Small Estate Affidavit Form Pdf Eforms

West Virginia Estate Tax Everything You Need To Know Smartasset

Estate Tax Return Chap 11 Article 11 Decedents Who Died After Ju

Create A Living Trust In West Virginia Legalzoom

State Estate And Inheritance Taxes Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die